Humanity has come a long way from barter methods of trading products to the use of cash. We live in a digital age when everything is at our fingertips. The internet has made our lives easier than ever before, from purchasing meals online to paying bills with a single click. Digital payments have played an important role in this.

Payment programs such as Phonepe, Google Pay, Paytm, and others have become an essential part of our lives. The UPI (Unified Payment Interface) is a single-interface payment system designed by the NPCI (National Payment Corporation of India) and is used for transactions on these applications.

What is UPI?

UPI is an acronym for Unified Payment Interface, which is a smartphone software that allows users to transfer money across bank accounts. It is a platform via which customers may link their bank accounts from several banks into a single UPI application and use their registered mobile phone number to seamlessly trade between them without paying any transaction fees. The UPI Platform is a UPI system that functions from numerous bank accounts in a single mobile application from participating banks, integrating different banking capabilities such as smooth fund routing and merchant payments. The National Payments Corporation of India (NPCI) created a mobile payment system with a single interface ( Mobile Payments). There is no need for customers to pay to make a transaction or to submit bank account information or other sensitive information every time they make a transaction. UPI has added additional capabilities such as in-app payments, cross-screen QR codes, web-based payments, and the extension of the wide variety of services to using UnionPay-powered e-wallets.

Thousands of businesses across hundreds of industries have realised the critical benefits of UPI Autopay and have opted in over the last year and a half. Let us take a step back to comprehend the rise and growth of this innovative payment mechanism in India, as well as its future prospects. The development of UPI has revolutionised recurring payments and taken them beyond our wildest dreams.

The Rise of UPI

UPI was first piloted by the National Payments Corporation of India (NPCI) and later introduced by Raghuram G. Rajan, then RBI governor, in 2016. UPI's target audience includes everyone who uses digital money transfer techniques.

Let's examine the emergence of UPI transactions in India and how they have become an important component of the country's expanding cashless environment.

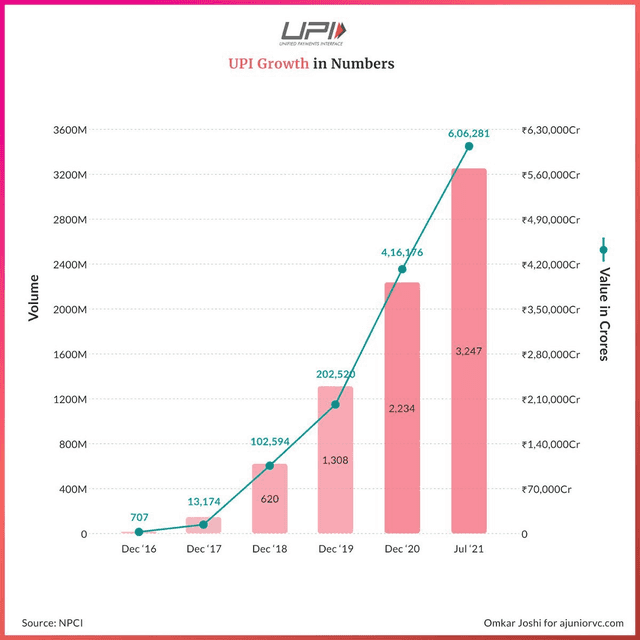

With the UPI payment ceiling of Rs. 1 lakh, over 3 billion transactions were conducted on UPI systems in 2018, with 620 million transactions exceeding the Rs 1 lakh crore mark alone in December 2018.

The value of online financial transactions in India climbed 10.5 percent between December 2019 and December 2020.

Digital transactions based on UPI climbed 110 percent in volume and 109 percent in value between June 2020 and June 2021.

UPI recorded 595 Cr transactions worth INR 10.4 Lakh Cr in May 2022 alone. UPI is now accepted in Nepal, Bhutan, Singapore, the United Arab Emirates, and France.

The Future of UPI

If present trends continue in the next few years, UPI's contribution to the nation's overall digital payments sector will grow considerably. The steady pace of growth seen in UPI payments might guarantee that the country's entire objective of 30 billion transactions is met in the next few years by up to 18%. NIPL is constructing an extensive acceptance network for UPI, which will allow Indian visitors to pay using this payment channel in their destination countries. With the expansion and expansion of the NIPL network, any Indian traveling to any place in the world would be able to utilize UPI as a payment method. NIPL is committed to revolutionising payments throughout the world via the use of technology and innovation. It will not only allow Indians to pay, but it will also help other nations improve their payment capabilities through technology support, advice, and infrastructure. The RBI is planning to release UPI on feature phones for around 400 million people to further expand the country's embrace of digital payments. This would further democratise UPI in the country and make digital payments more accessible. UPI for feature phone users will be called UPI123Pay and will have nearly all of the UPI functionality seen on smartphones. It will offer a variety of digital options, including UPI payment through an interactive voice response number, application functionality, a missed call-based approach, and proximity sound-based payments.

Receiving UPI payments

While the "no-code" wave for designing products has come, receiving and processing UPI payments is critical in establishing the business's future growth. No-code solutions like Razorpay and Cashfree’s payment pages allow you to construct unique web pages for selling courses and items online, collecting registrations for webinars or events, receiving donations for non-profit organizations, and much more. Payment Pages enables you to provide 100+ payment methods, such as UPI, NEFT, cards, EMI, and more, and go live in minutes. When it comes to using no-code technologies to simplify, automate, and develop, the possibilities are endless.

You may use Cashfree Payments Gateway Plugin | Bubble and Razorpay Plugin tailored for ease of use and practicality by Parentheses Labs to insert payment pages in your bubble apps using any code.

The phenomenal success and popularity of UPI is attributed to the vision of the Reserve Bank of India, NPCI, and various fintech businesses that built their apps on the basis of UPI's technology. Businesses have been able to establish and deliver trustworthy and responsive financial services because of UPI.